What is Section 80C?

Section 80C is a provision under the tax code that allows individuals to deduct a part of their taxable income so long as they make investments in certain specific avenues. The total deductions you could make under Section 80C are capped at 1.5 lakhs (bar a very specific instance which we will note later) and if you are still planning to save on taxes using the Section 80C quota, then here's a quick guide on all the options at your disposal.

Section 80C Deduction Calculator

Home Loan Principal Repayment

Allowed Tax Deductions

₹20,000

Max. Tax Savings

₹4,000

Talk to an expert today and

find the right insurance

for you.

1. Term Insurance Policy

A term insurance policy pays out a large lump sum to your family (nominees) in the event of your untimely demise. Nothing more. Nothing less. And while this may not seem like much, it is absolutely imperative for you to buy a term insurance policy if you have dependents. Let me give you an example. Imagine a 30-year-old individual, recently married with a home loan and a dependent spouse and child. If this individual were to pass away unexpectedly, the burden then falls on the dependent spouse and kids. This is a terrible scenario by all accounts. However, the individual could have eased the pressure considerably if they had bought a term insurance policy. A lumpsum of ₹2 Crores for instance (from the term policy payout) would have supported the family for another 10–15 years.

So if you have dependents, you should consider buying a term policy right now. The upside is that the premiums you pay are tax deductible. So if you paid ₹25,000 in premiums to buy a policy with a cover of ₹2 Crores, you can deduct this sum from your taxable income by invoking Section 80C.

And as a consequence, our first recommendation is to buy a term policy if you wanted to save on taxes.

2. Life Insurance policies

The distinction between a whole life insurance policy and a term insurance policy is that whole life insurance policies offer you a death benefit (money paid out to your nominees in the event you pass away) alongside additional monetary benefits, while term insurance policies only offer a death benefit. Now, at first sight, you may think life insurance policies have a distinct advantage. But that isn't true. The monetary benefits that life insurance policies offer don't compare to returns you could generate using a mutual fund. Even after adjusting for the tax benefits, most life insurance policies don't offer you a return in excess of 5–6%. While a simple investment in an index fund could yield returns of upwards of 10%.

The death benefit also pales in comparison when you consider a term insurance policy. If you're paying premiums of ₹1 lakh every year towards an endowment policy, you'd get death benefits of up to ₹10 lakhs. Meanwhile, you could pay a fraction of the sum and get a term policy with a cover of upwards of a crore.

The only benefit perhaps of owning a life insurance policy is that the premiums are usually pretty high. Which means if you wanted to avail benefits under Section 80C, you could simply buy a policy with an annual premium totalling ₹1.5 lakhs and deduct this entire sum from your taxable income. You don't have to invest in other instruments to make the most out of Section 80C provisions. However, we do not recommend this. Instead, we recommend buying a term policy and an ELSS scheme (which also extends Section 80 C benefits) to achieve the same objectives.

Friendly reminder: It's easy to get lost comparing policies and premiums. Instead of spending hours on it, why not get personalised insurance advice from Ditto? We offer free consultations with zero spam! Just 30 minutes to clarify all your doubts.

3. ULIPs (Unit Linked Insurance Plans)

Much like whole life insurance policies, ULIPs also extend the benefits of investments and insurance together. Every time you invest in a ULIP, a part of your premiums are set aside to offer you a death benefit, and the remaining is set aside in a fund that you can choose. Once again, these look like smart investment options, but they're not. After accounting for all the charges your returns barely breach the 6% mark. Occasionally if the fund performs well, these returns could look much better but you always have a better alternative i.e. investing in mutual funds yourself without handing over your premiums to an insurance company.

The death benefit once again pales in comparison to what term insurance policies offer. So it is a sub-optimal option all in all. And while you could deduct ₹1.5 lakhs from your taxable income by investing in ULIPs we do not recommend it. Instead, a better alternative is to buy a term policy and an ELSS scheme (which also extends Section 80 C benefits) and deduct the full ₹1.5 lakhs from your taxable income.

4. Equity Linked Savings Scheme

Equity meaning stock ownership. Equity-linked saving schemes meaning schemes that invest largely in stocks. And it's classified as a savings scheme because it has a lock-in period (of 3 years) during which investors will not be able to redeem their funds. And unlike ULIPs and endowment policies where upfront charges can be prohibitive, you can buy ELSS schemes at a low cost. So in the end, you have the potential to generate superior returns while availing tax benefits. So for instance, if you were an investor, you could set aside 1,50,000 (in SIPs or Lumpsum) in an ELSS scheme during any given financial year and deduct the entire ₹1.5 lakhs from your taxable income.

Now ideally we wouldn't recommend doing this all at once. Instead, if you were doing a Systematic Investment plan depositing something like 10,000 Rs every month, that would work really well.

5. Home Loan Premium Payment

With home loans, under various sections of the Income Tax Act, individuals can claim tax deductions for the repayment of either the

- interest section of the loan or

- towards the principal amount part of the loan

(Interest and Principal amount are the two components of a home loan).

Under Section 80C, individuals with a home loan can claim tax deductions of up to ₹1.5 lakhs/year on the taxable income on principal repayment in the loan. One can also include registration charges and stamp duty charges in this (only once across the tenure of the loan). However, to make this claim, an individual must not sell the house within 5 years of possessing it and have to mandatorily, complete the construction of the property first. That said, if the home is a ready-to-move-in one, the tax deductions can be claimed from the first year itself.

6. NPS

Now some people may feel equity-linked mutual fund schemes are a bit too risky for their appetite. They may want something more stable. Something long-term. Something that offers tax benefits under Section 80C provision but also something that isn't overly volatile.

The National Pension Scheme is a decent option in that case. Depending on what asset classes you choose, you could generate returns of upwards of 10%. Although considering the nature of the investments themselves, these are not guaranteed returns.

But first a quick brief on the pension system itself. You have a two-tiered account policy within NPS–Tier 1 and Tier 2.

Tier 1 accounts are a bit rigid. Once you make an investment here, you can't withdraw it anytime you like. In fact, you can't ever withdraw it fully. Instead, you will have to wait until the age of 60, to realize 60% of your corpus and settle for annuity payments (yearly payments, sort of like a pension) thereafter depending on what's left in your account. However, you do have a provision to withdraw about 25% of your corpus (after 3 years of investments) in special cases. These situations are restricted to emergencies and significant life events like a child's education, marriage etc. And bear in mind that the tax deductions are only applicable to investments you make in Tier 1 accounts.

You also have a Tier 2 account where you can invest your money and withdraw it anytime you like. The downside here however is that you cannot claim tax deductions on investments you make in Tier 2 accounts. So you have to keep this in mind.

Finally, let's look at the actual tax deductions that you can claim.

You can claim deductions of up to ₹1,50,000 if these are investments you made as an employee. You can also claim deductions on your employer's contributions (if any) up to 10% of your basic salary. However, put them together you can claim deductions of up to ₹1,50,000.

In addition to this, if you continue to invest in an NPS tier 1 account, you can claim deductions of an extra 50,000 under Section 80CCD (1B).

So in principle, you can claim total deductions of up to 2,00,000 by investing in NPS accounts.

However, we do not recommend you invest a large part of your money in an NPS account simply to save on taxes because this money will mostly be made available to you post the age of 60. So if you feel like you need liquidity, setting aside large amounts of money here may not be a wise move. However, if you're already investing money in an NPS account for retirement purposes alone, then you can most certainly put the tax deductions to good use here.

Talk to an expert

today and

find

the right

insurance for you.

7. Employee Provident Fund

Now let's suppose you need a retirement account, but you like a guaranteed return as opposed to something variable — the kind you receive with an NPS account In that case, private employees have the provision to enroll themselves into an Employee Provident Fund. Every time you make a contribution based on your salary structure, your employer will also match the contribution by depositing a similar amount in your EPF account.

The principal and the interest will continue to accrue into the account until one of two things happen. If you reach the age of 58 years, then you can withdraw your EPF contributions fully. Or if you are unemployed for two months or more, you can once again withdraw the proceeds. The government also extends the opportunity to withdraw the balance in your PF account in special situations — education, purchase of land, marriage, medical emergency, home loan repayment, etc.

And the biggest upside (outside of the guaranteed returns of ~7%) is that the contribution you make is eligible for tax deductions and you can deduct up to ₹1.5 lakhs from your taxable income if these are your own contributions and not your employers. However, once again, many employees would rather prefer to make the bare minimum contribution to the EPF account (considering the meager returns and the long lock-in periods) and keep a large portion of their salary themselves. This will depend on how your salary is structured and as a consequence investing in an EPF to avail tax deductions alone may not be the most prudent option.

8. Public Provident Fund

The problem with NPS and EPF to a large extent is that you have to set aside the money until retirement and you'll never be able to withdraw the proceeds fully. A public provident fund meanwhile offers slightly better flexibility. Once you make an investment in a PPF account, they will be tied up for 15 years before you can withdraw them, but once they mature at this point, you can get your hands on the entire proceeds immediately. And much like NPS and EPF, you can make partial withdrawals after completing 5 years in the event you have to deal with emergencies or significant life events like a child's education, marriage etc.

Returns are fixed at 7% as of today and you get tax benefits on top i.e. you could deduct up to ₹1.5 lakhs from your taxable income if you invested that sum in a PPF.

Do we recommend it? Once again, we would only recommend it for individuals looking to save money for very specific use cases — Retirement, children's education etc. If you are looking to make meaningful investments and extract a decent return, this may not be the best way to go about things.

9. National Savings Certificate

Imagine you don't want to deal with the lock-in periods imposed by Public Provident Fund. Imagine you want to invest your money in a similarly secure fund where you know outcomes are guaranteed and a place where you can avail tax benefits. Well, in that case, the National Savings Certificate is a good option. It doesn't offer world-beating returns (in fact, it may not even beat inflation) but it only imposes a lock-in period of 5 years. And you have guaranteed returns on top. All you need to do is visit a post office/bank and open an NSC account and you'll be good to go. And you can deduct a maximum of ₹1.5 lakhs from your taxable income if you were investing in NSCs.

Once again, it's not an option we recommend since it barely beats inflation. But if you are worried about liquidity and you need guaranteed returns perhaps you could consider setting aside some of your proceeds here.

10. Tax Saving Fixed Deposits (FDs)

If you feel like you don't want to deal with an NSC account, then tax savings FDs are a good alternative. Like NSCs, you have a lock-in period of 5 years. And you get Fixed deposit-like returns (which may not even beat inflation at times). And while you may think that you can simply withdraw proceeds from a Fixed Deposit anytime you like by paying a penalty, you can't do that with tax savings FDs. That money is locked in good for 5 years and while you do have the provision to deduct a maximum of ₹1.5 lakhs from your taxable income, the lock-in periods may come as a surprise to most people.

Do we recommend this option: Well, once again, like NSCs, this is not something that will generate mouth-watering returns, but if you want something guaranteed, maybe you could consider this option

11. Sukanya Samriddhi Yojana (SSY)

Outside of these generic investment options, the government also offers a very specific savings scheme for the development of the girl child. At first, that detail may not seem like much, but it is relevant here. When you make an investment in an SSY account, the money is locked in for 21 years. But the objective here is to nudge parents to use the proceeds to help the girl child. So you can only open an SSY account if you have a girl child between the ages of 5 and 10

Also, you have the provision to withdraw 50% of the proceeds before maturity in 2 special cases–marriage or higher education of the girl child. And finally, you also have the provision to deduct up to ₹1.5 lakhs from your taxable income if you made investments in a Sukanya Samriddhi account.

Do we recommend this option: The returns are slightly better here compared to other guaranteed income products and the proceeds at maturity aren't taxed. However, unless you are saving for a girl child, then this may not be the most prudent option since you have a massive lock-in period of 21 years.

Why Should You Buy 1 Crore Term Insurance Through Ditto?

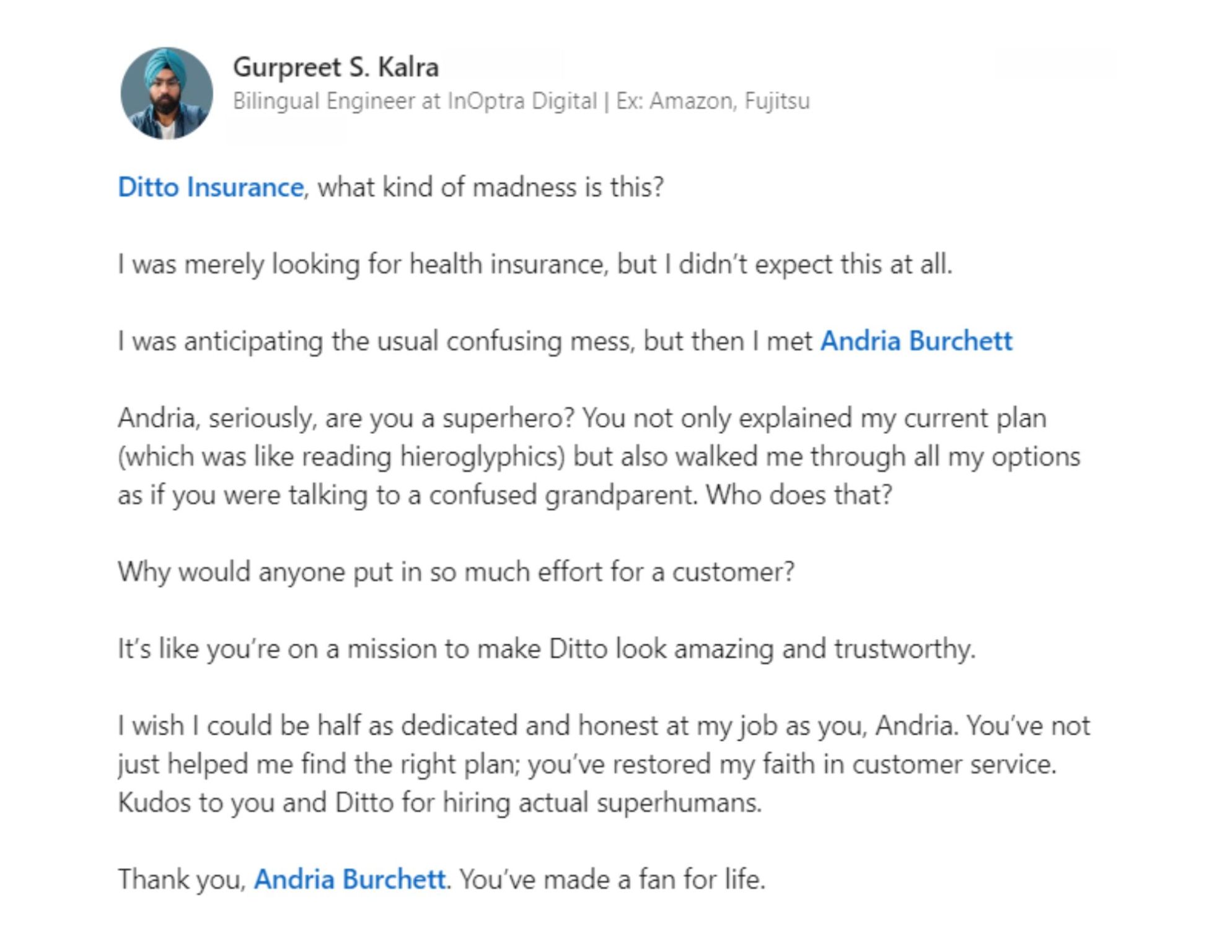

At Ditto, we've assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Gurpreet below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

Final Conclusion

If you are looking to optimize returns over the long run, then the best way to save taxes under the Section 80C provision is to simply buy a term insurance policy and put the remaining funds in an ELSS, through a systematic investment. However, if you have very specific use cases — retirement, a child's education etc, perhaps could consider the other options we've outlined in the article above.

Talk to an expert

today and

find

the right

insurance for you.