Personalized Advice on

Term Life Insurance

Health Insurance

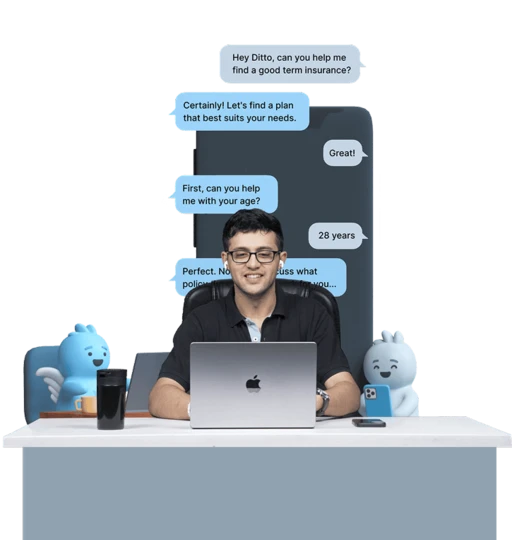

The Ditto Experience

For a long time, one item on our to-do list was to build an insurance platform free of conflicts, mis-selling, spam, &, most importantly, advisors to handhold people through the purchase journey. And then we met the Finshots team, and Ditto happened.

Insurance Buying Experience

Shortlisting

Application & Payment

Policy Issuance

Choose Ditto for a well-guided insurance purchase

Why People Trust Ditto

India's #1 Insurance Advisor:

Ditto is one of India's highly rated insurance advisors with a stellar 4.9 Google rating from 12,000+ happy customers.

Insurance Checklist

We know how difficult it can be to navigate through hundreds of policies. So we've designed this handy checklist to make sure you know exactly what to look for in a good policy

Frequently Asked Questions