Term Insurance Calculator

Find the best term insurance cover for your needs with our free calculator. Simply enter your age, expenses, and other details to get started.

Your age

Enter your age (in years)

18 yrs

80 yrs

Protection duration

Enter the age till which you want your coverage to last (in years)

18 yrs

80 yrs

Monthly expenses

Enter your average monthly expense

Do not include EMIs and investments in expenses.

Outstanding Loans

Enter any unsecured outstanding loans

Disclaimer: Insurers set an upper limit to your coverage based on your income and education.

How do you choose the right term insurance coverage?

This article will explain how to choose the right term cover for your profile, the different methods available to compute this figure and which method you should consider.

What is Term Insurance?

A term cover is an extension of a very simple idea. What amount of money should your family receive in your absence? If you think 1 Crore fits the bill, then you buy a term insurance policy with a cover totaling 1 Crores. In your absence the family will receive this sum tax free.

However, choosing the right cover can be particularly challenging since different financial advisors swear by different methods. However, we won't inundate you with complicated formulae. Instead we will use a few simple calculations to arrive at a figure that should do the job.

Talk to an expert

today and

find

the right

insurance for you.

Why Should You Opt For A Term Insurance Policy?

Term insurance plans have become immensely popular over the last few decades. While a section of this can be attributed to the growing financial awareness among the millennials and Gen X, a few of the features of term insurance plans also deserve the share of the credit -

- Financial protection: One of the primary concerns that you have when you think about your family's well-being in the event of your unfortunate demise is their financial security. With your income being compromised, how will they achieve their life stage goals (think marriage, childbirth, home loans, etc.)? The answer to all this is a term insurance policy - a cover amount that will be your financial replacement, thus securing your family's financial future.

- Affordability: Let's say you are a 25-year-old male who does not smoke and is looking for a ₹1 Crore cover for your term insurance plan till you turn 65. Your annual premium will range from ₹10k - ₹12k. This is probably less than your grocery bill for a couple of months! Considering this cover amount will be your income replacement during your unfortunate absence, doesn't the premium seem affordable?

- No risk involved: Term insurance plans are not market-linked and thus fetch no returns. In the event of the policyholder's death during the policy tenure, the beneficiary receives the same amount (unless there is an inflation/life stage benefit-based boot in cover) as chosen during policy purchase. Thus, since there is no return involved and no market links, there are no market fluctuations to be worried about. The corpus (sum assured) remains a constant financial fund to fall back upon when needed.

- Flexibility of customisation: Term insurance plans almost always come with a host of riders. The primary purpose of these term riders is to customise the policy per the policyholders' and their families' tailored financial and life stage goals. The riders include-

- Critical Illness Benefit: Insurers offer a list of critical ailments. If you are diagnosed with either of these ailments, the insurer offers you a substantial lump sum to be used at your discretion. This amount may be deducted from your base cover (Accelerated Critical Illness Benefit) or maybe over and above your base amount (Critical Illness Benefit).

- Waiver of Premium: In case you are diagnosed with a critical illness or are left totally and permanently disabled, your source of income will surely be compromised. Under such circumstances, how can you continue paying your premium to keep your term insurance plan active?

To meet this financial crunch, the Waiver of Premium kicks in, wherein you don't have to pay the remaining premiums to keep the policy active for the entire tenure. - Accidental Death Benefit: If the policyholder's death is caused by an accident (within 90 or 120 days from the day of the accident—based on the insurer and the chosen policy), the insurer offers an additional amount over and above the base amount.

- Accidental Total and Permanent Disability: If you are left totally and permanently disabled due to an accident, your source of income becomes severely compromised. Thus, the insurer offers you a sum that will be disbursed as a lump sum or as monthly instalments to act as your income replacement to fund your daily expenses.

- Increasing/Decreasing Cover: Term insurance providers are usually very stringent about their regulations - this includes leaving the cover amount unchanged across the policy tenure. However, what if you purchased a term insurance plan when you were unmarried, and now you are married and have a child to plan for financially?

This is where an Increasing Cover rider can come to use. Whether it's about an -

- inflation-based boost in cover (in which case the cover amount increases by a certain % across the policy tenure) or

- a life stage benefit (wherein the cover amount increases at once by a certain amount)

- this rider helps you boost your cover amount to cater to the changing financial requirements and goals.

- Terminal Illness Benefit: Say you are diagnosed with a terminal ailment, and the doctor offers a written declaration stating that you have a poor prognosis and only a few months to live. Under such circumstances, you are walking on a financial tightrope, and you don't know if you should use your savings to set up a fund for your child or use it to try for better treatment or try and fulfil any bucket list wish. Subsequently, the insurer offers you a lump sum (from the cover amount or over and above it, based on the term insurer and the policy) to use at your discretion.

Please remember that you may not require all these term insurance riders; however, some of these are value-worthy add-ons that will customise your plan and increase the policy's value. So, when choosing a term insurance plan, ensure that the policy offers at least some of these riders.

Talk to an expert

today and

find

the right

insurance for you.

What Factors Influence Your Term Insurance Cover Amount?

Now that you know how to choose a term insurance plan, it's time you learn how to decide the ideal cover amount. First of all, remember this - in the case of term insurance cover, "one size DOES NOT fit all."

Your ideal cover is determined by a few factors -

- Number and Age of Dependents: The more the number of dependents and the younger they are, the higher your cover amount because you will need top keep funding them till they become financially independent.

Thus, say Mr. A with 1 son (10 years) and a spouse (35 years) needs a cover of say ₹2 crores.

Again, in that case, Mr. B, with 1 son (5 years), 1 daughter (2 years), and a spouse (35 years), will definitely need a cover of more than ₹2 crores.

However, remember - this is JUST ONE of the factors influencing your ideal cover amount.

- Policy Tenure: In the case of term insurance plans, you have to choose a policy tenure when purchasing the policy. Policy tenure is the number of years or the age of the policyholder till which he/she stays covered under the policy.

Now, think of the purpose of term insurance plans - they are your income replacement. So, ideally, the policies should stay active till your retirement age. However, in case you are anticipating that your dependent children might need a few more years to become financially stable, you can always extend the policy for a few yeras. However, remember that the average life expectancy in India is 70. So, if your policy tenure is stretched beyond you turning 70, your premiums will shoot up substantially. So, try to choose a term policy coverage until you are between 60 and 70.

- Monthly Expenses & Outstanding Loans: While term insurance policies require pocket-friendly premiums, you must analyse your financial bandwidth and ensure you can afford the premiums (if you skip a single premium, your policy will lapse).

Thus, when calculating your term insurance coverage, it's important to consider and acknowledge your monthly expenses, including your child's fees, groceries, medical expenses, travelling costs, rent, etc and any outstanding loans that you have which require EMIs.

- Inflation: Inflation, i.e., the rising cost of commodities, the standard of living and the cost of living is a factor that should influence your term insurance coverage.

Now, while term insurance base amounts can't be altered during the policy tenure, you can always opt for an increasing cover perk (for life stage perks and inflation). Such term insurance riders will help you avoid complicated calculations that have to be made during choosing an ideal term insurance cover.

Ideal Coverage for Term Insurance Plans

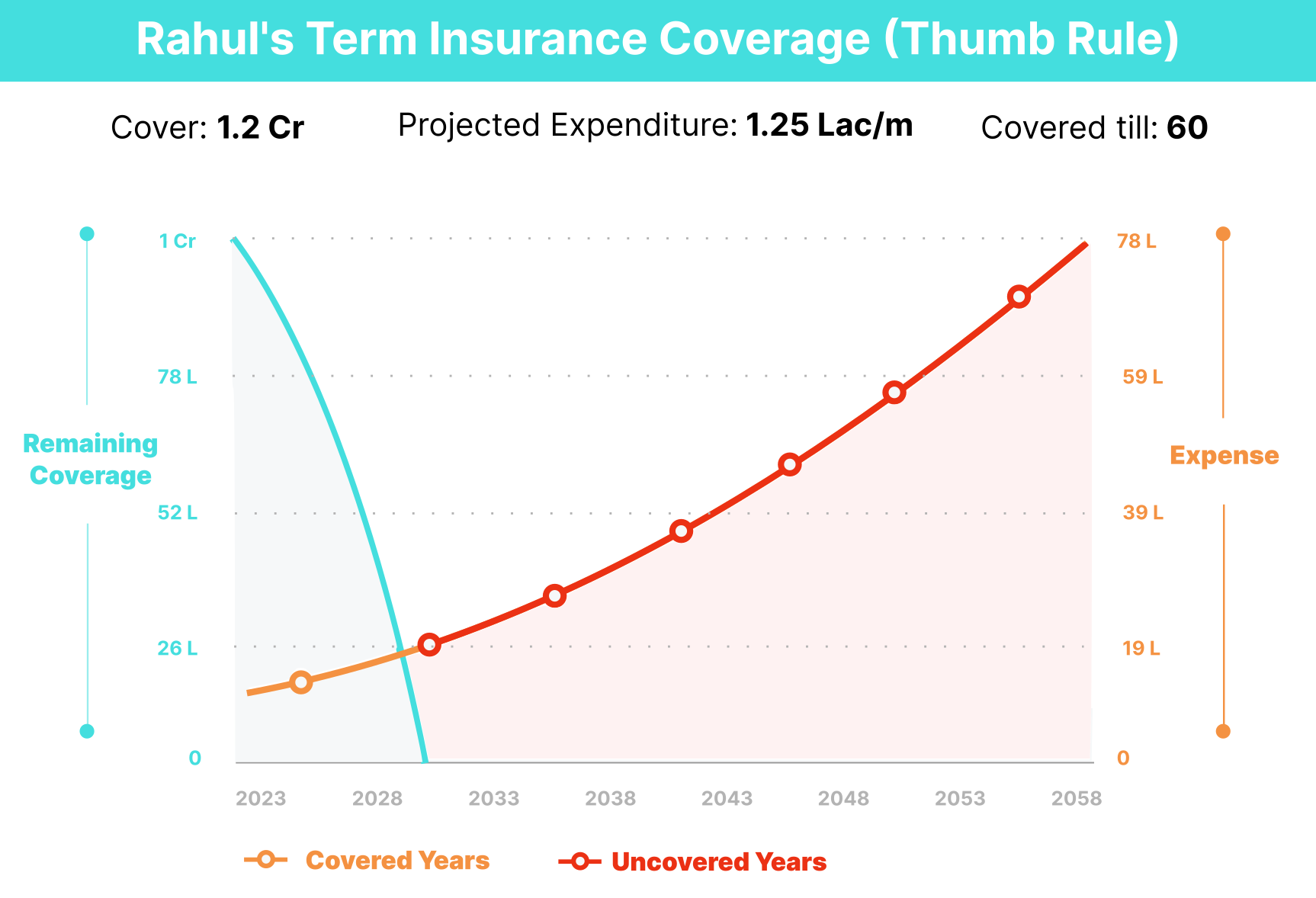

Before we do that, we need to bust a quick myth on using a popular thumb rule i.e. Many people say that you can choose your cover by simply assigning a multiple to your current annual income. So if you were making 12 lakhs an annum then you can simply multiply that number by 10 and buy a term policy with a cover totalling 1.2 crores i.e. 10 x 12 lakhs.

This is very easy to do. Unfortunately, it's not a very robust way to calculate the cover.

Why?

Well, perhaps the problem can be best illustrated by using the example below,

1

How to Calculate Term Insurance Coverage the Right Way

In order to calculate the term insurance coverage, let's take the example of Rahul who is currently 26 and earning ₹12 Lakhs per annum. And his situation is very dynamic. He wants to get married next year, buy a house and even have kids soon after. He also knows that to cover these expenses, he needs quick promotions. He needs to double his salary over the next 2-3 years. And he will have to change his lifestyle considerably.

| 26 Year Old, Single, Living in a Metro City | ||

|---|---|---|

| Expense Category | Amount (monthly) | Details/ Assumptions |

| House Rent | ₹8,000 | Rent of 1BHK |

| Local Transportation | ₹1,000 | |

| Food | ₹2,000 | With occasional eat-outs |

| House help | ₹1,500 | |

| Parent's Expenditure | ₹12,500 | |

| Total | ₹25,000 | |

While his expenses today are fairly limited, they could rise at least 5 times by the time he turns 30. And while his dependents include his parents who need a mere ₹1.5 lakhs every year, he will have a spouse and a newborn by the age of 30. Together his dependents will need ₹15 lakhs when he turns 30.

| 30 Year Old, Married, Living in a Metro City | ||

|---|---|---|

| Expense Category | Amount (monthly) | Details/ Assumptions |

| House Rent | ₹30,000 | |

| Car Loan EMI | ₹20,000 | Considering a loan of 10,00,000 @ EMI rate of 7%, taken for 5 years |

| Fuel Cost | ₹4,000 | |

| House help | ₹10,000 | Cleaning + Cooking |

| Food | ₹2,000 | |

| Insurance (Health + Term + Motor) | ₹3,500 | |

| Miscellaneous | ₹15,000 | Stationery, Clothes, etc. |

| Son's Education Fee | ₹10,000 | |

| Parent's Expenditure | ₹12,500 | |

| Total | ₹1,25,000 | |

So in the event of Rahul's passing at the age of 30, his family will need ₹15 Lakhs per annum at the bare minimum. They may need even more as Rahul's kids grow up. Unfortunately none of these details are captured using the thumb rule method. It doesn't capture his changing lifestyle. It doesn't capture his rapid increase in income. Nor the change in dependents. So it falls short in many ways.

Ideally what Rahul should be doing is this. At the age of 26, he should be projecting his future expenses. Now this isn't easy to do and it won't always be super accurate. But it will give Rahul an estimate. Once you project the expenses into the future, you can see how much money Rahul's family (and his dependents) will need in his absence.

At this point you ask yourself one simple question.

If Rahul's family gets ₹1.2 Crores at the age of 30 (cover calculated using thumb rule). Then how many years can they sustain without Rahul?

Well, let's see that shall we?

After 8 years, they will run out of money. However, If Rahul were alive, then he would have supported the family until retirement. Not just for 8 years. So in reality the thumb rule method falls short of protecting Rahul's family's needs. We now know that the family needs much more than ₹1.5 Crores.

But how much?

Talk to an expert

today and

find

the right

insurance for you.

2

Calculating Coverage Amount (Ideal Sum Assured for your term plan)

Well, to figure out what kind of money the family will actually get with term insurance, here's what you do.

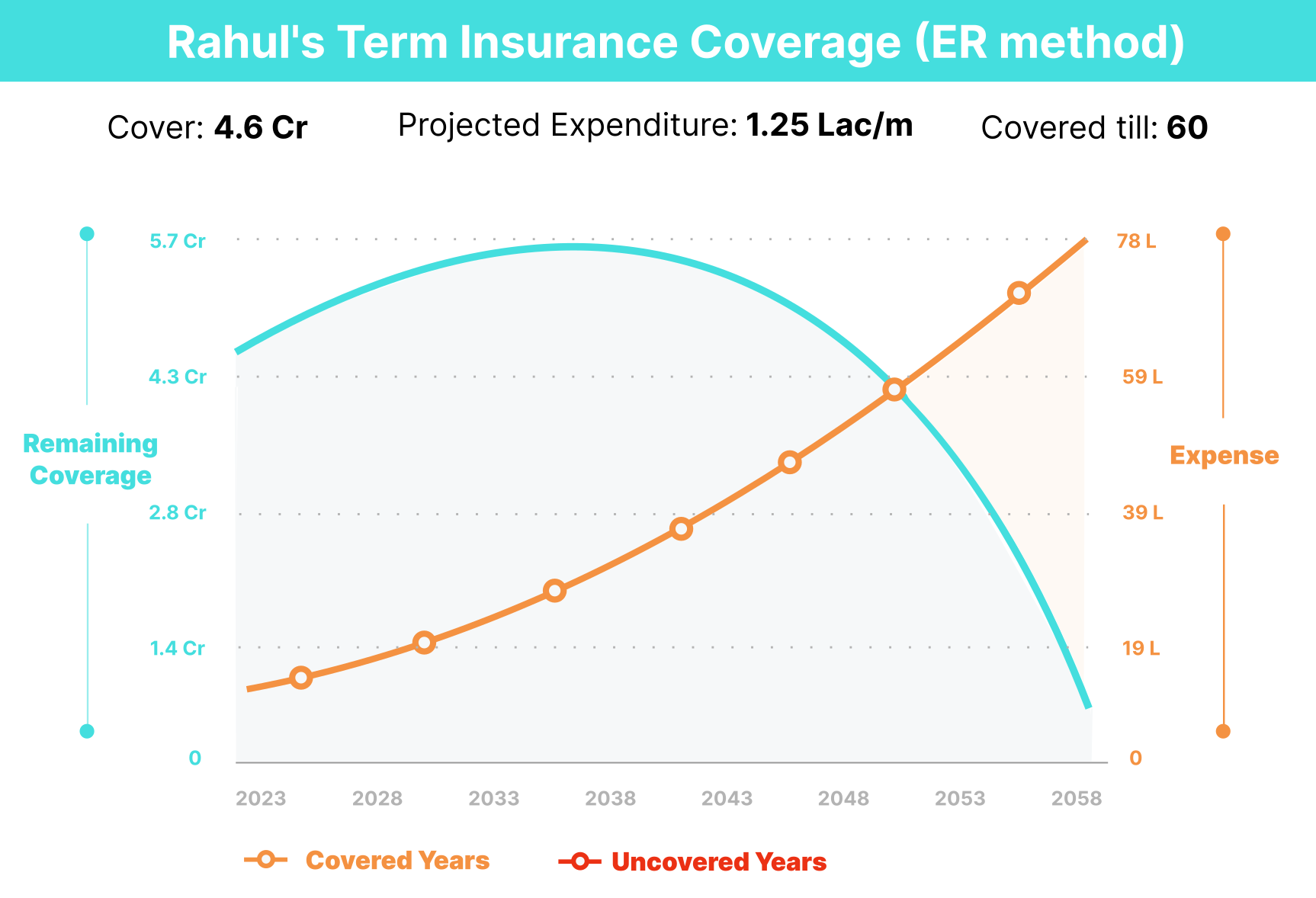

First you project his family's expenses until 60. I've assumed that the expenses will rise with an inflation rate of 5%. And I have added a buffer in the beginning to account for any miscellaneous expenses that may crop up in the future i.e. expenses Rahul may have to incur as his kids keep growing older. I also know that Rahul would have retired by 60 during which time his children would be independent and his retirement savings–substantial. This means by 60, his spouse would have ample funds to tide over the rest of her life even in his absence.

So if Rahul wanted to cover his family's expenses until 60, he would need ₹4.6 Crores. This is illustrated in the figure below.

And this would ensure his family would always have enough money in the bank to manage their lifestyle irrespective of what happens to Rahul.

This is called the expense replacement method. And it's a much better way to calculate the ideal cover. You can also do the same thing with income. Instead of projecting your expenses into the future. You can project your income until retirement and see what cover you need.

And both methods underscore the same idea. You have to create a financial replica of yourself. And this financial replica should provide the same cashflows that you would have extended to your dependents if you were alive. Once you do that, the term cover should take care of your family's needs.

Just be sure to account for all future expenses and you should be good to go.

Note: Insurance companies may not always extend the cover you need because they have their guidelines on how to calculate the total cover. Please speak to our advisors to get a better understanding of how this actually works.

How Do You Use Our Free Term Insurance Cover Calculator?

So now you know what your ideal term insurance coverage should be. However, knowing this procedure and calculating the exact amount - are two different stories. Our free term insurance cover calculator is a good place to start if you need a quick reference point. Here's how you can use this free tool-

STEP 1: Enter your age.

STEP 2: Enter the policy duration (the age till which you want your term insurance protection).

STEP 3: Enter the monthly expenses (rent + education charges + groceries + medical expenses + travelling charges). But make sure there are no loan- or investment-related charges included here.

STEP 4: Enter the monthly EMIs for your outstanding loans.

STEP 5: Click on the "Calculate" tab, and you'll have your ideal term insurance cover amount.

Also, remember that this is only expected to serve as a reference point for people looking for a quick number. We always suggest you speak to our advisors before finalizing your term plan.

Why Should You Buy 1 Crore Term Insurance Through Ditto?

At Ditto, we've assisted over 8,00,000 customers with choosing the right insurance policy. Why customers like Gurpreet below love us:

No-Spam & No Salesmen

Rated 4.9/5 on Google Reviews by 10,000+ happy customers

Backed by Zerodha

100% Free Consultation

You can with our team. Slots are running out, so make sure you book a call now!

What Are the Most Affordable (Cheapest) Term Insurance Policies For 2025?

While you are getting acquainted with the ideal term insurance cover and its calculations, do also make a note of the most affordable and best term insurance policies for 2025 -

Frequently asked questions

You have three Options:

Buy another Term Plan: It is difficult to predict all variables in life- expanding income, changing lifestyle and Inflation. Another term plan later in life can provide the extra protection but obviously the premium will also increase.

Buy an increasing cover option: There are increasing cover term plans options which increase cover by a fixed percentage every year. But they have a cap on max cover that the term plan can reach.

Buy a term plan with Life Stage option: If the cover becomes inadequate because of major life events like- Marriage or child, cover can be increased by a fixed amount at an additional premium.

Yes, you can purchase multiple term plans; however, we recommend limiting it to 3-4 to avoid complications for your nominees when coordinating and claiming them.

Additionally, it's important to disclose all existing policies when applying for a new one.

Talk to an expert

today and

find

the right

insurance for you.